Syntax codifies

business models

Data without structure is only numbers.

Our data empowers clients to identify, classify, and analyze financial products better than ever before.

Syntax brings a unique perspective to investment management analytics and processes. Drawing on proprietary methodologies derived from the biotech industry, we define the DNA of companies and investment portfolios with pinpoint clarity. Through its financial analysis platform, Affinity, and its financial indices, Syntax empowers investors to meet their investment objectives with precision and accuracy.

Affinity®

View profiles for thousands of individual companies and ETFs with granular exposure details.

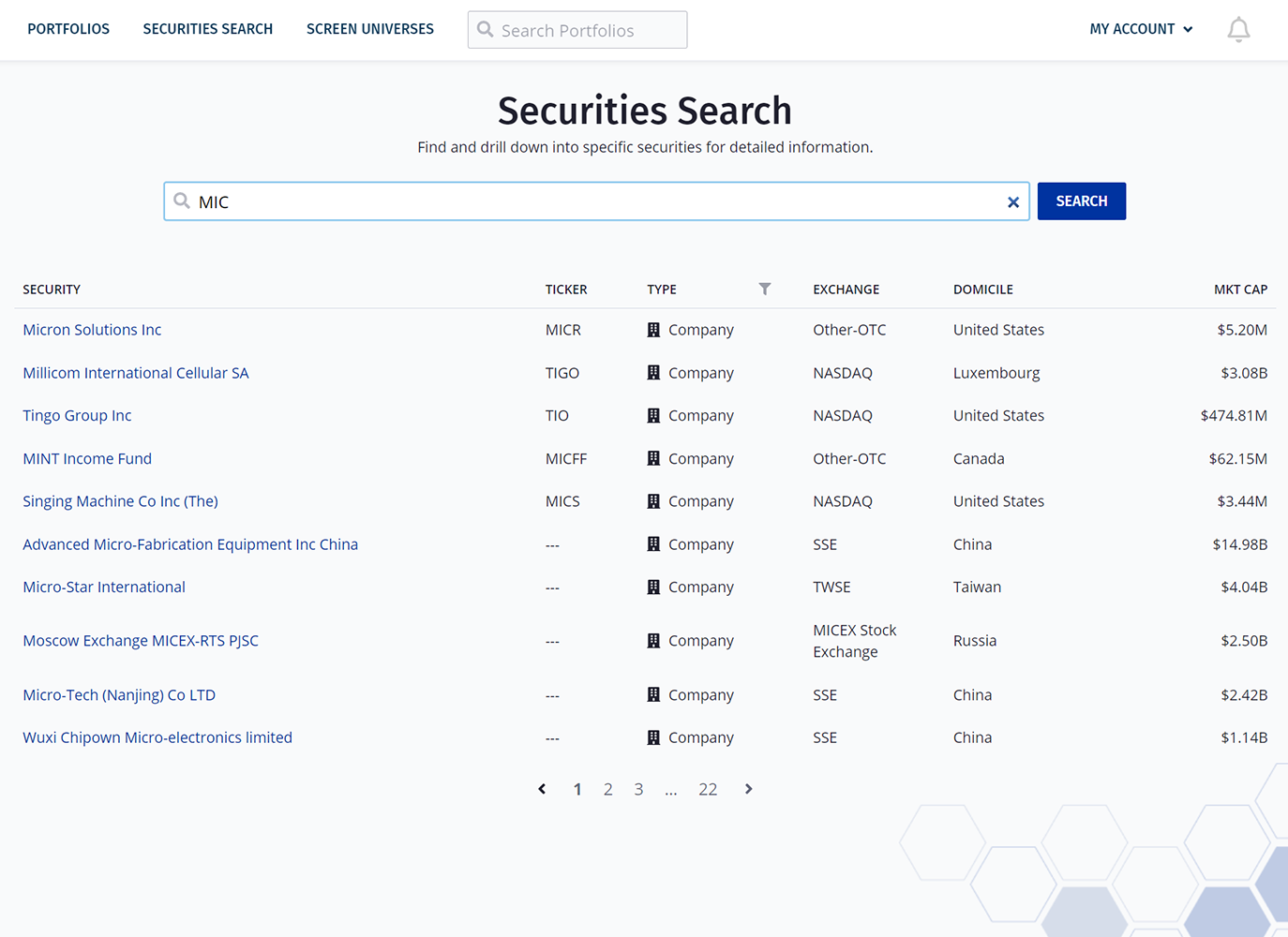

Find companies that have target exposures from various equity universes.

Upload portfolio holdings to find hidden exposures across over 40+ different lenses and more than 1,500 unique exposures.

Indices

Sector Indices

Syntax’s suite of over 600 sector-based indices tracks market performance using groups from its proprietary FIS classification system that range from broad top-level sectors to granular business segments and activities within a sub-industry.

Learn MoreBenchmark Indices

Syntax has developed its own proprietary set of up-to-date Benchmark Indices that mirror the performance of the commonly used benchmarks.

Learn MoreStratified Weight Indices

Syntax's proprietary Stratified Weight Indices unravel the inefficiencies embedded in capitalization weighted indices to present an optimal solution for balancing risk and reward.

Learn MoreThematic Indices

Using proprietary Affinity analytics, Syntax develops Thematic Indices that capture emerging and evolving market trends with pinpoint accuracy in a timely fashion.

Learn MoreCustom Indices

Syntax works with a range of clients, including ETF issuers, institutions, and family offices to develop Custom Indices that precisely fit their needs.

Learn MoreESG Indices

Syntax uses a vast array of data and proprietary data sets to develop a growing range of ESG, SRI, and SDG Indices that reflect prevailing responsible investment goals.

Learn MoreLatest News and Research

.png)

Understanding the Growing Investment Opportunity in Cyber Security

By Paul Kenney, CFA on

.png)

Names Rule Solutions

By Syntax on

Breaking Down the Basics: EU Taxonomy Green Revenue Eligibility

By Lea Mayer on

About Syntax

Syntax LLC is a financial data and technology company that codifies business models. Syntax operates through three segments: Company Data, Wealth Technology, and Financial Indices. Using its patented FIS® technology inspired by systems sciences, the Company Data segment offers the most comprehensive, granular, and accurate product line revenue data available on the market. The Wealth Technology segment then uses this abundance of data to facilitate the instantaneous creation and ongoing management of direct indexing solutions and rules-based equity portfolios through a fully automated platform. The Financial Indices segment enables Syntax to deliver customized and proprietary indices, including core global benchmarks and micro- and macro-thematic, smart beta, defined outcome, and target volatility indices. These indices are foundational for a range of financial products, such as ETFs, UITs, and structured products.