By Jonathan Chandler, CFA on

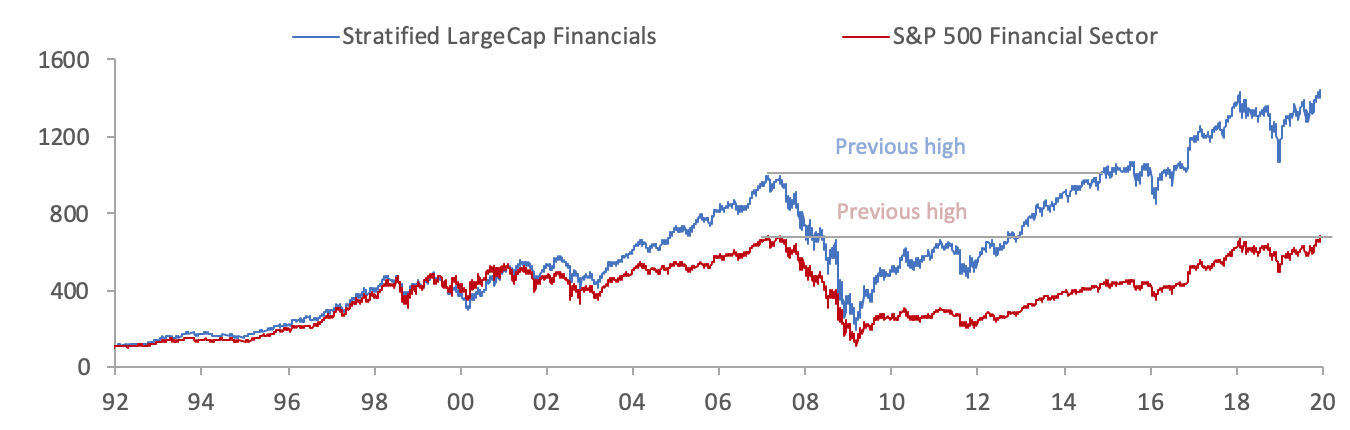

When investors think about diversification, they are usually looking to reduce downside volatility. However, a more diversified approach can be just as helpful in enhancing returns during a market recovery. The S&P 500 Financials Sector has given investors a turbulent ride over the last decade. Since that index peaked on February 20, 2007, it has had an incredibly sluggish recovery. Just yesterday, almost thirteen years after the last peak, the index achieved a new all-time high.

Why did the recovery take so long? The S&P 500 Financials Index is a cap-weighted index, so the largest companies – JP Morgan, Wells Fargo, Bank of America – are given by far the largest weight. From February 2007 to today, the largest 10 companies in the Financials sector comprised, on average, 53.6% of the index. Moreover, these mega-cap companies are all engaged in similar businesses. This means the S&P 500 Financials Index contains concentrated risk exposures and is therefore not fully diversified.

Syntax’s Stratified Weight approach is designed to increase business diversification. By reducing exposure to any one kind of supply chain, customer group or product type, Stratified Weight can help avoid shocks to groups of related securities, like big banks, that were structurally derated during the financial crisis.

Through its improved diversification, the Stratified LargeCap Financials index had a much speedier recovery. While its 2007 peak occurred on the same day as the S&P 500 Financials Index, its subsequent peak was on October 31, 2014, over 5 years sooner than the cap-weighted index. And over the almost thirteen years that the S&P 500 Financials Index was underwater, Stratified LargeCap Financials earned a 44.6% cumulative price return. Put simply, diversification matters.

Through its improved diversification, the Stratified LargeCap Financials index had a much speedier recovery. While its 2007 peak occurred on the same day as the S&P 500 Financials Index, its subsequent peak was on October 31, 2014, over 5 years sooner than the cap-weighted index. And over the almost thirteen years that the S&P 500 Financials Index was underwater, Stratified LargeCap Financials earned a 44.6% cumulative price return. Put simply, diversification matters.

Disclaimers

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. All performance presented prior to the index inception date is backtested performance. Backtested performance is not actual performance, but is hypothetical. The inception date of the Syntax Stratified LargeCap Index was December 27, 2016. The backtest calculations are based on the same methodology that was in effect when the index was officially launched. However, back-tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index. Charts and graphs are provided for illustrative purposes only.

The Syntax Stratified LargeCap Index (“the Index”) is the property of Syntax, LLC, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Index is not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices will not be liable for any errors or omissions in calculating the Index. “Calculated by S&P Dow Jones Indices” and the related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Syntax, LLC. S&P® is a registered trademark of Standard & Poor's Financial Services LLC (“SPFS"), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). The Financials Sector subset of the Syntax Stratified LargeCap Index is calculated using model performance generated by Syntax in FactSet, and as such may differ from index calculations performed by S&P Dow Jones Indices.

Syntax®, Stratified®, Stratified Indices®, Stratified-Weight™, Stratified Benchmark Indices™, Stratified Sector Indices™, Stratified Thematic Indices™, and Locus® are trademarks or registered trademarks of Syntax, LLC and its affiliate Locus LP. FactSet® is a registered trademark of FactSet Research Systems, Inc.

Index performance does not represent actual fund or portfolio performance and such performance does not reflect the actual investment experience of any investor. An investor cannot invest directly in an index. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in a portfolio invested in accordance with an index. None of the Syntax Indices or the benchmark indices portrayed herein charge management fees or incur brokerage expenses, and no such fees or expenses were deducted from the performance shown; provided, however that the returns of any investment portfolio invested in accordance with such indices would be net of such fees and expenses. Additionally, none of such indices lend securities, and no revenues from securities lending were added to the performance shown.

The S&P 500® Financials Index is an unmanaged index considered representative of the US mid- and large-cap financials sector stock market. Benchmark data for the S&P 500 Financials Index is provided by S&P Dow Jones through FactSet®.

This document is for informational purposes only and is not intended to be, nor should it be construed or used as an offer to sell, or a solicitation of any offer to buy, any security. Additionally, the information herein is not intended to provide, and should not be relied upon for, legal advice or investment recommendations. You should make an independent investigation of the matters described herein, including consulting your own advisors on the matters discussed herein. In addition, certain information contained in this factsheet has been obtained from published and non-published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for the purpose used in this factsheet, such information has not been independently verified by Syntax and Syntax does not assume any responsibility for the accuracy or completeness of such information. Syntax LLC, its affiliates and their independent providers are not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein.

Certain information contained in this report is non-public, proprietary and highly confidential and is being submitted to selected recipients only. Accordingly, by accepting and using this factsheet, you will be deemed to agree not to disclose any information contained herein except as may be required by law. This report and the information herein may not be reproduced (in whole or in part), distributed or transmitted to any other person without the prior written consent of Syntax. Distribution of Syntax data and the use of Syntax indices to create financial products requires a license with Syntax and/or its licensors. Investments are not FDIC insured, may lose value and have no bank guarantee.